THE FIRST MACHINE MADE DOLLARS IN THE NEW WORLD

THE FIRST MACHINE-MADE DOLLARS IN THE NEW WORLD

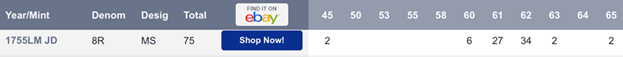

Spanish Colonial Silver “Pillar” Dollars (8 Reales) from Peru

A Special Selection from 1754 and 1755

· Legal Tender in the U.S. until the Coinage Act of 1857 passed!

· Spanish colonial silver is the very beginning of the Red Book of U.S. coinage

· The U.S. Dollar is based on this 8 Reales size and metal standard

· The FIRST milled (machine-made) silver dollar of the New World!

· The standard of international trade, this was the most important trade coin of this era, and circulated worldwide.

· And most interestingly, the origin of the Dollar Symbol!

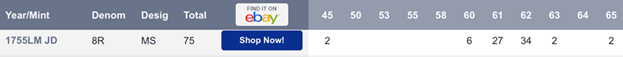

· Only 73 1754 coins graded total at NGC, and only 75 1755 coins graded!

More about the coin and its iconic design

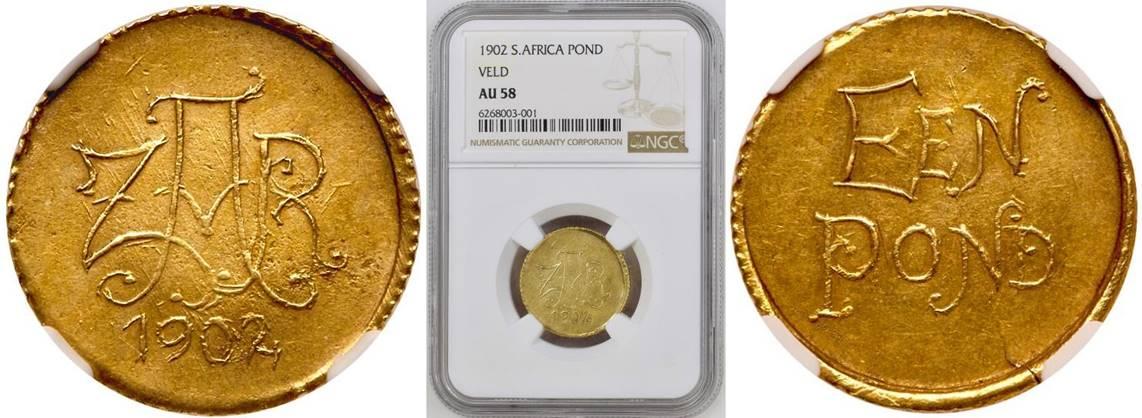

The “pillar” series was first issued under Spanish Colonial rule at

the Mexico City mint in 1732 and production lasted until 1772. This type

was such an important source of coinage for the entire world economy

that it was eventually struck at mints throughout the New World,

harnessing the vast discoveries of silver. Production and mintage

figures varied, producing some major rarities, especially in MS grade.

For example, Peru only produced this type from 1751 until 1772.

Remarkably, NGC has only graded 422 coins for the entire series of

Peruvian Pillars, and the two dates offered here have impressive census

figures.

It was designed to replace the hand struck “cob” series and featured

cutting edge coin-press technology and perfectly circular planchets with

a newly incorporated edge design. The latter novel characteristic was

to prevent clipping, an all-important feature of the time since the

coin’s exchange monetary value was directly linked to its intrinsic one.

The precise silver content of this new design, coupled with its

beautiful and striking design, helped cement and establish its place as

the most important world trade coinage in the 18th and 19th centuries.

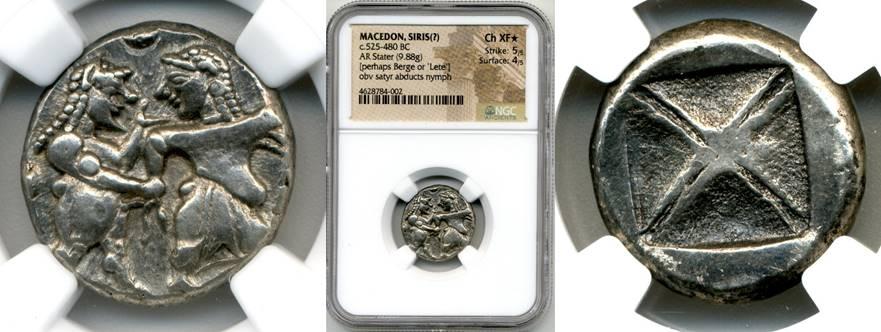

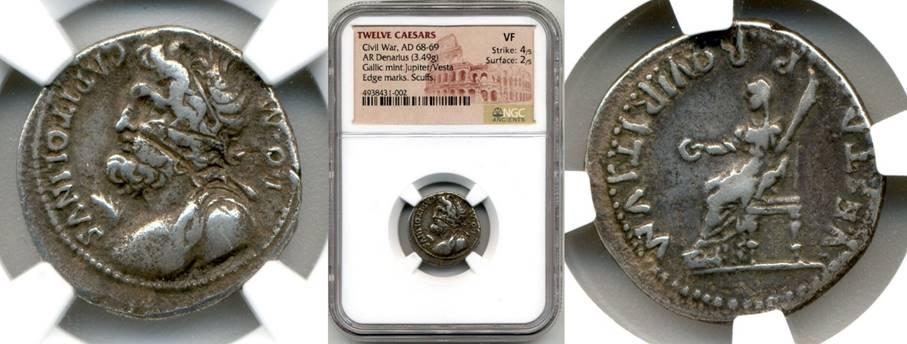

The obverse features two globes representing the “old” and “new”

worlds atop the Atlantic Ocean encircled by the great “Pillars of

Hercules” with the inscription PLUS ULTRA on the left and right ribbons

on the columns, which translates to “MORE BEYOND”. The circular

inscription “UTRAQUE UNUM” translates as “United we are one”.

The reverse shows the Castille and Leon coat of arms of the Spanish

kings and the inscription “PHILIP V D G HISPAN ET IND REX” for “Philip

V, king of Spain and the Indies by the grace of God”. The first part of

the legend would change, reflecting the ruling Spanish King at the time.

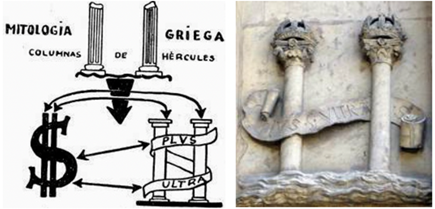

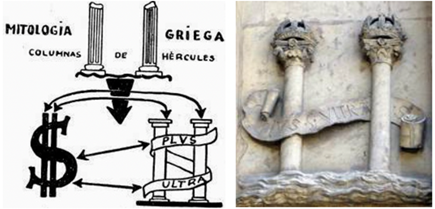

THE ORIGIN OF THE DOLLAR SIGN

The Pillars of Hercules were of course the well-recognized symbol

for the Strait of Gibraltar separating the Atlantic Ocean and the

Mediterranean Sea, and in Greek mythology represented the limits to the

known world, a barrier not to cross. The ribbon atop the columns and the

abbreviation “Ps” (for “Pesos”, the Spanish equivalent to an 8 Reales

coin) are generally recognized as the origin for the current U.S. Dollar

sign “$”.

Thus, the design on this coin symbolized the powerful united Spanish

Colonial empire in Europe and the Americas that had expanded the

boundaries of the known western world after Columbus’s 1492 voyage.

The Spanish Colonial “Pillar” Dollar issue quickly established itself

as the most important trade coinage of the era in both the American and

Asian commercial arenas and was legal tender in the United States until

the Coinage Act of 1857. As such, it is rightly featured as one of the

first coins listed in the current Red Book and noted as the most

familiar currency in Colonial America.

The Pillars of Hercules Legend has it that Hercules smashed through a

mountain, connecting the Atlantic and the Mediterranean Sea just south

of Spain.